Your Step-by-Step Guide to Launching a Successful Cryptocurrency Project

In this guide, we'll explore all the strategies on how to launch a successful Crypto project.

Launching a cryptocurrency project is no small feat. It involves careful planning, strategic decision-making, and a good understanding of both the technological landscape and market dynamics. Whether you're preparing for a token listing, orchestrating a mainnet launch, or aiming to sustain momentum post-launch, every step requires precision and foresight.

In this guide, we'll walk you through the essential phases of a successful crypto project launch. From the importance of strategic sequencing of your announcements to choosing the right exchanges for listing and finally ensuring a robust mainnet launch, you'll find actionable insights that pave the way for a successful introduction of your project to the market. Our goal is to empower you with knowledge and strategies that are practical, implementable, and tailored to enhance your project's visibility and success in the competitive crypto landscape.

Let's dive into the intricacies of a crypto launch, starting with strategic sequencing to maximize impact and engagement.

Part I: Strategic Sequencing

Understanding Strategic Sequencing

Strategic sequencing is the art of timing your cryptocurrency project's milestones to maximize impact and market receptivity. This includes deciding the order of your mainnet launch, token listing, and other key announcements. The sequence in which you unveil these elements can significantly influence your project's initial perception and long-term viability.

Case Study: The Ethereum Transition

A prime example of strategic sequencing is Ethereum's transition to Ethereum 2.0. This transition was announced well in advance, building anticipation and allowing developers and investors to align their strategies with the network's upgrades. The phased rollout demonstrated the importance of a systematic and well-communicated sequence to maintain user trust and market stability.

Binance Coin (BNB) Migration

Binance initially launched BNB on the Ethereum blockchain but later transitioned to its own Binance Chain. The announcement was strategically timed before the launch, building anticipation and ensuring a smooth transition for token holders. This move significantly increased the usability of BNB and cemented Binance Chain's position in the market.

Aligning Product Goals with Launch Strategy

Before you decide the order of operations, consider your project's specific goals:

If you aim to attract developers, it might be beneficial to launch your mainnet first, providing a solid foundation for them to build upon.

For projects targeting immediate market presence, listing the token might take precedence to capitalize on market trends and build liquidity.

Developing a Roadmap

Your roadmap should reflect a strategic sequence that supports your project's long-term goals. It should be clear, realistic, and detailed, laying out each phase of the launch process. This roadmap guides your team and communicates to potential investors and users what they can expect and when they can expect it.

Communicating with Your Audience

Transparency is key in building trust. Regular updates about your progress, especially if there are delays or changes in the schedule, are crucial. This maintains investor confidence and user engagement, showing that you value their involvement in your project's ecosystem.

Leveraging Announcements for Maximum Impact

Each announcement should be leveraged to gain maximum attention and traction. For example, coordinating a token listing announcement with a major update about your mainnet can create a significant buzz and draw eyes to your project. Timing these announcements around major crypto events or leveraging media cycles can also amplify your reach.

Part II: Listing and Launch

Choosing Between DEXs and CEXs

When planning your token listing, one of the first decisions is whether to list on a decentralized exchange (DEX) or a centralized exchange (CEX). This choice can significantly influence your project's accessibility and liquidity.

DEX vs. CEX: Strategic Considerations

Decentralized Exchanges (DEXs):

Pros: Greater control over the listing process, typically lower fees, and alignment with the decentralized ethos of the crypto community.

Cons: Potentially lower liquidity and visibility compared to CEXs.

Example: Uniswap has become a popular choice for many new projects due to its permissionless listing process. This allows projects to gain immediate market access without requiring lengthy and costly approval processes.

Centralized Exchanges (CEXs):

Pros: Higher liquidity, broader user base, and often enhanced credibility with mainstream investors.

Cons: Higher costs, more stringent listing requirements, and a longer preparatory phase.

Example: Chainlink benefited from its early listing on Coinbase, significantly boosting its visibility and market liquidity. This demonstrates the impact of a strategic CEX listing.

How Exchanges Choose Projects

The process by which exchanges select projects for listing is multifaceted, focusing on factors that indicate a project's potential for success and longevity.

Community and Traction: Exchanges evaluate the size and engagement level of a project's community. A vibrant, active community suggests a healthy demand and a potential for sustained trading activity.

Innovative Technology: Projects offering unique or breakthrough technologies are more likely to be noticed. This was evident when Ethereum was quickly listed on major exchanges due to its introduction of smart contracts.

Regulatory Compliance: It is critical to ensure that your project meets the regulatory requirements of the exchange's operating country. Ripple's XRP faced challenges due to regulatory scrutiny, affecting its listings on several major exchanges.

Considerations for Token Launch

Planning your token launch involves more than just deciding where to list. It requires a comprehensive strategy considering financial, marketing, and operational aspects.

Financial Considerations: Understand the costs involved, including listing fees, marketing expenses, and any potential legal fees. Projects like EOS and Tezos raised significant funds through their ICOs, which helped cover these substantial costs.

Market Strategy: Timing your market entry can be as crucial as choosing the exchange. Align your listing with market conditions and investor sentiment to maximize impact.

Exchange Relationships: Building a good relationship with exchange staff can facilitate smoother listings and support. The team behind Binance's BNB coin leveraged their industry connections for a swift and successful launch.

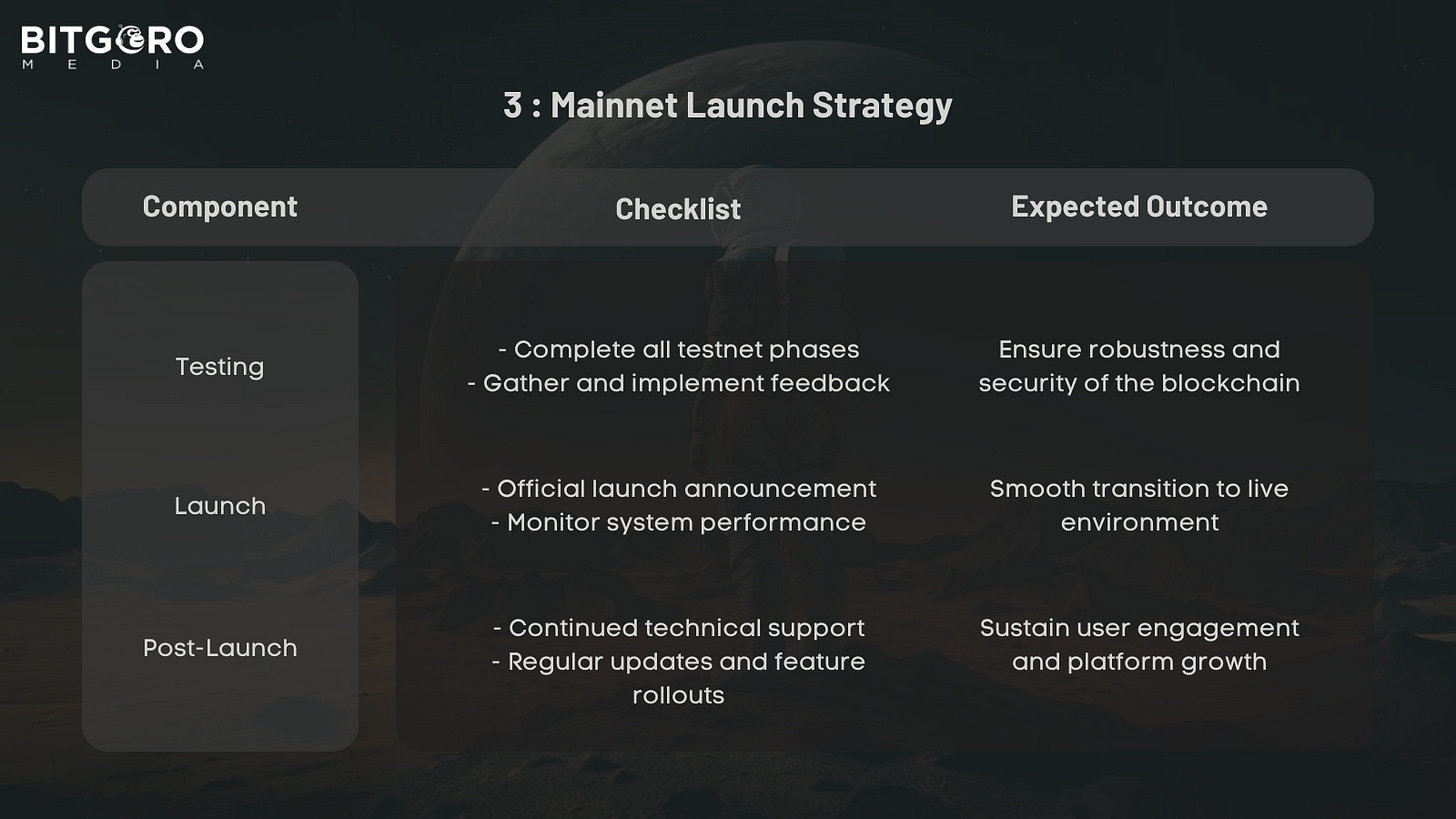

Part III: Mainnet and Post-Launch

Launching the Mainnet

The mainnet launch marks an important milestone in a cryptocurrency project's lifecycle. It is the point where the blockchain becomes fully operational and open to the public. The strategy behind when and how to launch your mainnet can greatly impact the project's adoption and stability.

Strategic Considerations for Mainnet Launch

Pre-Launch Testing: Ensure your blockchain is robust and secure through extensive testing phases such as private nets and testnets. Ethereum, for example, had multiple testnet phases (e.g., Ropsten, Rinkeby), which were crucial for stress testing the network before the mainnet launch.

Community Engagement: Before the mainnet launch, ramp up community engagement to build anticipation and ensure a strong initial user base. Cardano effectively used this strategy by involving the community in iterative testing and feedback cycles.

Security Audits: Conduct thorough security audits to mitigate potential vulnerabilities. Projects like The DAO suffered greatly from security flaws, underscoring the importance of rigorous security checks before going live.

Mainnet Launch Timing

After Listing: Launching the mainnet after your token is listed can benefit from the market's anticipation and the established investor base. Polkadot followed this strategy, allowing it to secure substantial funding and community support before its mainnet release.

Before Listing: Launching the mainnet before the listing can demonstrate the project's technical viability and attract serious investors who are more interested in the project's fundamentals than speculative trading. Cosmos took this approach, establishing a functioning network before pursuing major exchange listings.

Sustaining Momentum Post-Launch

Maintaining momentum after the mainnet goes live is critical for the project's long-term success. This phase is about growing the ecosystem, enhancing the technology, and keeping the community engaged.

Strategies for Post-Launch Success

Continuous Development: Keep improving the platform with new features and updates. Ethereum's constant upgrades and transition to Ethereum 2.0 are prime examples of how ongoing development can sustain interest and investment in a project.

Ecosystem Growth: Encourage the development of applications on your platform to grow the ecosystem. Binance Smart Chain (BSC) has successfully attracted a wide array of developers and projects, significantly boosting its utility and value.

Partnerships and Integrations: Forge strategic partnerships to enhance your project's credibility and reach. Chainlink's numerous partnerships with various DeFi projects have been instrumental in its widespread adoption and success.

Community Incentives: Implement incentive mechanisms to reward community participation and foster project loyalty. Projects like Stellar have used airdrops effectively to increase token distribution and engage a broader audience.

Other Key Considerations

Navigating Regulatory Waters

Compliance with regulatory requirements is one of the most pivotal considerations for any crypto project. The landscape of cryptocurrency regulation varies significantly across jurisdictions, and staying informed can be the difference between success and failure.

Regulatory Liaison: Establish a liaison or hire experts to handle regulatory compliance and keep the team updated on changes. Ripple's proactive engagement with regulators has been central to its strategy despite facing significant legal challenges.

Adaptation to Regulatory Changes: Be prepared to quickly adapt your project to meet new regulatory standards. Binance has repeatedly adapted to regulatory pressures by modifying its operations across different countries, illustrating the importance of agility in regulatory compliance.

Ensuring Scalability and Interoperability

As your project grows, the ability to scale and interact with other blockchains becomes essential.

Layered Architecture: Consider adopting a layered architecture to improve scalability. Bitcoin's integration of the Lightning Network as a second-layer solution effectively handles scalability by allowing off-chain transactions.

Cross-chain Bridges: Develop or integrate cross-chain bridges to facilitate interoperability among different blockchains. Cosmos is an example of a project that enhances interoperability with its Inter-Blockchain Communication (IBC) protocol.

Conclusion

In this comprehensive guide, we've journeyed through the intricate process of token listing, from strategic considerations and exchange selection to mainnet launch and post-launch strategies. The roadmap outlined here is designed to provide you with the knowledge to successfully navigate the complex terrain of cryptocurrency markets.

Remember, the key to a successful listing and sustained project growth lies not only in meticulous planning and strategic execution but also in your project's ability to adapt to the ever-changing market dynamics and regulatory environments. By staying informed, engaged, and proactive, you can significantly enhance your project's prospects.